Volatility in global markets to inflation, disruption caused by technology, and political instability, today’s investor faces an increasingly challenging financial landscape in which to operate. Yet, uncertainty does not have to mean inaction. With a smart, strategic investment plan, we can protect wealth but also find opportunities for growth, even during difficult times.

Understanding the New Economic Reality

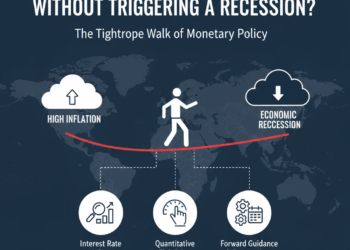

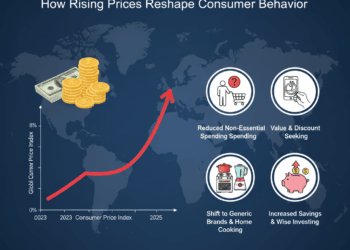

We live in times of unpredictability in the world’s economy. Pandemics, geopolitical tensions, and climate crises have shown how suddenly markets can turn. Inflation pressures and fluctuating interest rates make financial planning complicated. In such times, traditional investment strategies, either based on short-term gains or single-asset-focused, will just not work.

Prudent investment planning starts with a realistic view of risk. The successful investor does not try to predict the future but instead prepares for several futures. That means building a portfolio that will find a balance between stability and flexibility, enabling one to adapt as economic conditions change.

Diversification: Bedrock of Stability

One of the most powerful approach to uncertainty is diversification. Diversification across asset classes, including equities, bonds, real estate, and commodities, diminishes vulnerabilities to market volatility. When one sector is underperforming, the overall impact can be compensated for by positive returns in another sector. Additional protection could be made possible with global diversification. Investing in international markets exposes investors to new opportunities for growth at the same time as limiting the risk of a single economy.

The Role of Technology in Smarter Investing

Digital innovation has transformed the way people handle their finances. Advanced analytics, robo-advisors, and investment apps ensure that financial planning in the future will be more accessible, data-driven, and effective. Advanced tools analyze market trends, suggest portfolio adjustments, and help investors make better decisions in near real-time.

Nowadays, market pattern detection and risk assessment employ more and more AI and machine learning. This inherently offers greater transparency to younger investors, with greater control because they can monitor their portfolio from anywhere. Yes, digital tools have great power, but they exist to supplement human judgment and a long-term strategy, not to displace them.

Focus on Long-Term Value

The temptation to grab quick profits or otherwise overreact to the market gyrations is there in times of uncertainty. Smart investors know, however, that discipline and patience will win the day in the long run. Forget trying to time the market, focus instead on time in the market—remaining invested and letting compounding returns work over the years.

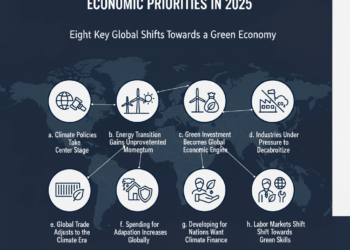

This resilience can be afforded by investing in renewable energy, healthcare, technology, and other related sectors for the long term. These industries are underpinned by structural trends that look through short-term volatility. Building an emergency fund while keeping some liquidity ensures flexibility when any unexpected opportunities or challenges present themselves.

Consulting a Professional

While self-investing may be a good idea, seeking professional advice from a financial advisor is crucial, especially during volatile economic times. Professionals offer personalized advice and help mitigate risk by checking whether investment decisions align with your overall financial plan. A great advisor provides perspective to help you avoid making emotional choices during volatile markets.

Conclusion: Turning Uncertainty into Opportunity

Uncertainty might be inevitable, but it is the right strategy that makes it an opportunity. An intelligent investment strategy, anchored on diversification, insight into technology, and long-term thinking, can effectively turn instability into a strong foundation. It is not change that one should fear, it’s about changing with the times. Prudence combined with innovation helps investors confidently deal with an unpredictable economy. In the end, smart investing is not about foreseeing the future but preparing for it.