Finances are easier to handle today. At the same time, digital banking, e-commerce, and investment apps have made financial management more accessible to everyone. Still, these facilitate impulsive spending and short-term pleasure. It’s not about money management anymore when trying to find the right balance between saving and spending. It is an important strategy in life that will dictate the long-term stability and quality of life for each individual.

The Psychology of Money

Any financial planning should begin with the realization of one simple fact: money is not just a tool, but also a reflection of values, priorities, and emotions. In modern life, people are often sent the message that success should be measured in terms of what we own, not what we save for the future. Social media and digital marketing will urge consumers to keep spending, seeking satisfaction.

As financial psychologist Dr. Brad Klontz once said, “How we handle money is more about psychology than math.” That pretty much sums up the reasons it’s so hard to find a balance between saving and spending. Again, this requires gaining control by first understanding emotional triggers-to comfort, status, or convenience, for example-behind financial decisions.

Why Saving Matters More Than Ever

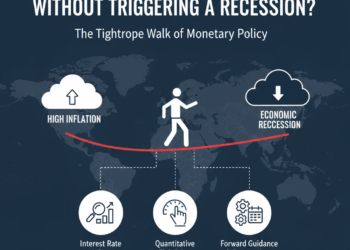

In an unpredictable economy, saving has been a form of security. Economic recessions, job instability, and inflation all remind us that financial safety nets are important. Savings not only protect against emergencies but also enable future opportunities such as education, travel, or entrepreneurship.

To this end, experts suggest the “50/30/20 rule” as a workable standard: 50% should go to needs, 30% toward wants, and the remaining 20% toward savings or debt reduction. Of course, this ratio may vary depending on an individual’s goals and level of income-the general principle applies: save constantly and build resilience.

As financial advisor Suze Orman once said, “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” Savings, therefore, are not just about accumulating wealth but also about reducing stress and increasing peace of mind.

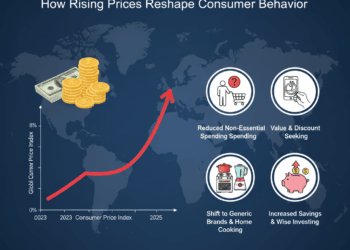

The Importance of Mindful Shopping

It’s not only about saving but also about spending wiser. The overly frugal, or overly productive, are missing out on opportunities and living a life of reduced quality. The goal isn’t to limit spending completely; it’s being strategic about it. Conscious shopping means aligning purchases with your values: choosing experiences and items that are truly needed or have long-term value.

Modern technology already made it easier to track the spending and categorize your expenses. Applications such as Mint or YNAB will give real-time insights into where money is going, thus helping you identify waste and redeploy resources toward meaningful goals.

Balancing for the Future

The challenge for modern adults, particularly those in the 20-50-year-old bracket, is to find a balance between short-term pleasures and long-term planning. Investing in education, health, and experiences pays returns beyond just financial value. Simultaneously, continued saving and investing ensures that those dreams of the future-buying that house, retiring comfortably-remain within reach.

Financial experts also recommend setting a variety of savings goals: an emergency fund, a retirement plan, and an investment portfolio. Diversifying one’s savings keeps it both flexible and secure. In times of uncertainty, the most valuable asset becomes one’s adaptability.

Final Plan: The Art of Financial Balance

It’s not about saving versus spending, but finding the right balance for living life. A healthy financial life allows for happiness today and prepares for future challenges. As the great investor Warren Buffett once said, “Do not save what is left after spending, but spend what is left after saving.” His words remind us that discipline, not income, determines true financial success.

In the end, smart financial planning is not about restriction, it’s actually about freedom. Mastering that delicate balance between saving and spending can lead people to lives that are both financially secure and emotionally satisfying.