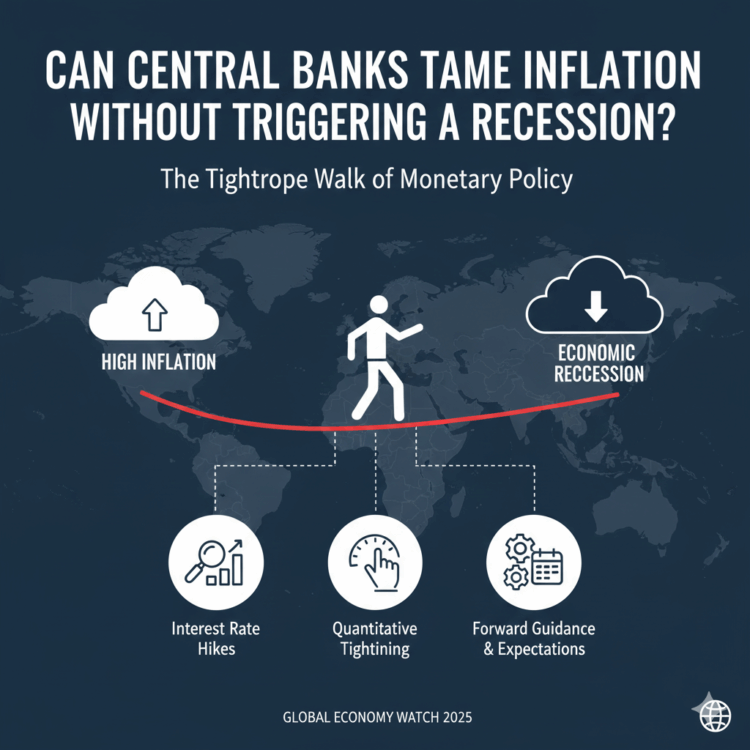

With 2025 beckoning, one question dominates the world’s economic debate: can central banks take down inflation without ushering their economies into recession? Two years of aggressive rate increases have, yes, eased inflation in large swaths of the world-but not by enough to persuade policymakers that the fight is over. An extremely critical question thus arises. Can central banks pull off the enviable “soft landing,” or is a recession ordained?

The High Inflation Challenge

Inflation in most of the major economies, such as the United States, the Eurozone, and parts of Asia, still runs above target. Essential items like food, housing, and energy still bear more-than-usual price tags. However, while supply chains have improved post-pandemic, structural factors such as labor shortages, rising wages, high oil prices, and geopolitical disruptions have kept inflation sticky. Central banks can’t afford to cut rates too soon, for they risk re-igniting inflation. Yet keeping rates high for too long can choke off economic activity.

Why Soft Landings Are Difficult to Achieve

A “soft landing” occurs when the central bank can reduce inflation without a sharp increase in unemployment, or in the level of GDP. Historical soft landings are rare because monetary policy operates on the economy with long and unpredictable lags.

Some of the complicating variables include:

- Lagged effects of rate rises, which take around 9–18 months fully to feed through to the economy.

- The vulnerable household facing the strained cost of living.

- Businesses are cutting investment, limiting productivity growth.

- Linkages in the world economy, whereby a slowdown in one affects the others.

Besides, because inflation is global while financial conditions vary among countries, coordinating a soft landing becomes even more complex.

The Higher-for-Longer Rate Era

Most of the central banks are adopting a policy stance of “higher for longer”. The idea behind this policy is to smoothly bring down the rate of inflation, avoiding sudden shocks.

But it also means that consumers and businesses have to deal with:

- Higher mortgage and loan rates

- Tighter credit conditions

- Increased financing costs of investment

- Slower job growth

While its intent is to cool an overheating economy, the risk is that demand could fall too quickly and tip the economy into recession.

Consumer Spending Showing Signs of Weakness

Consumer expenditure, which is a large percentage of many of the world’s economies, started to slow down. Households turn increasingly cautious with borrowing costs on the rise and real wages still recovering from the peak of inflation.

Key Indicators include:

- Declining retail sales in several advanced economies

- Slowing demand for durable goods, such as cars and electronics

- Weakening housing markets due to expensive mortgages

If consumer confidence continues to spiral downward, the likelihood of recession becomes very high.

Businesses Under Growing Pressure

Companies are dealing with a challenging cocktail of soaring labor costs, weakening demand, and more expensive access to capital. Many companies have scaled back expansion plans, paused hiring, or cut inventory orders. In particular:

- Export orders decline, say manufacturers

- Tech companies have slowed investment in R&D.

- Small businesses are struggling to obtain accessible credit.

As companies pull back, the broader economy is becoming more vulnerable to contraction.

Emerging Markets Fear a Spillover Effect

In particular, emerging markets are sensitive to global monetary tightening. Higher U.S. interest rates strengthen the dollar and make external debt more expensive for developing countries. Large outflows of capital, currency depreciation, and high prices of imports heighten the risk of financial stress. The path to avoid recession while fighting inflation is even more treacherous for these countries. Monetary tightening can do more harm than good in the absence of stable exchange rates and strong fiscal frameworks.

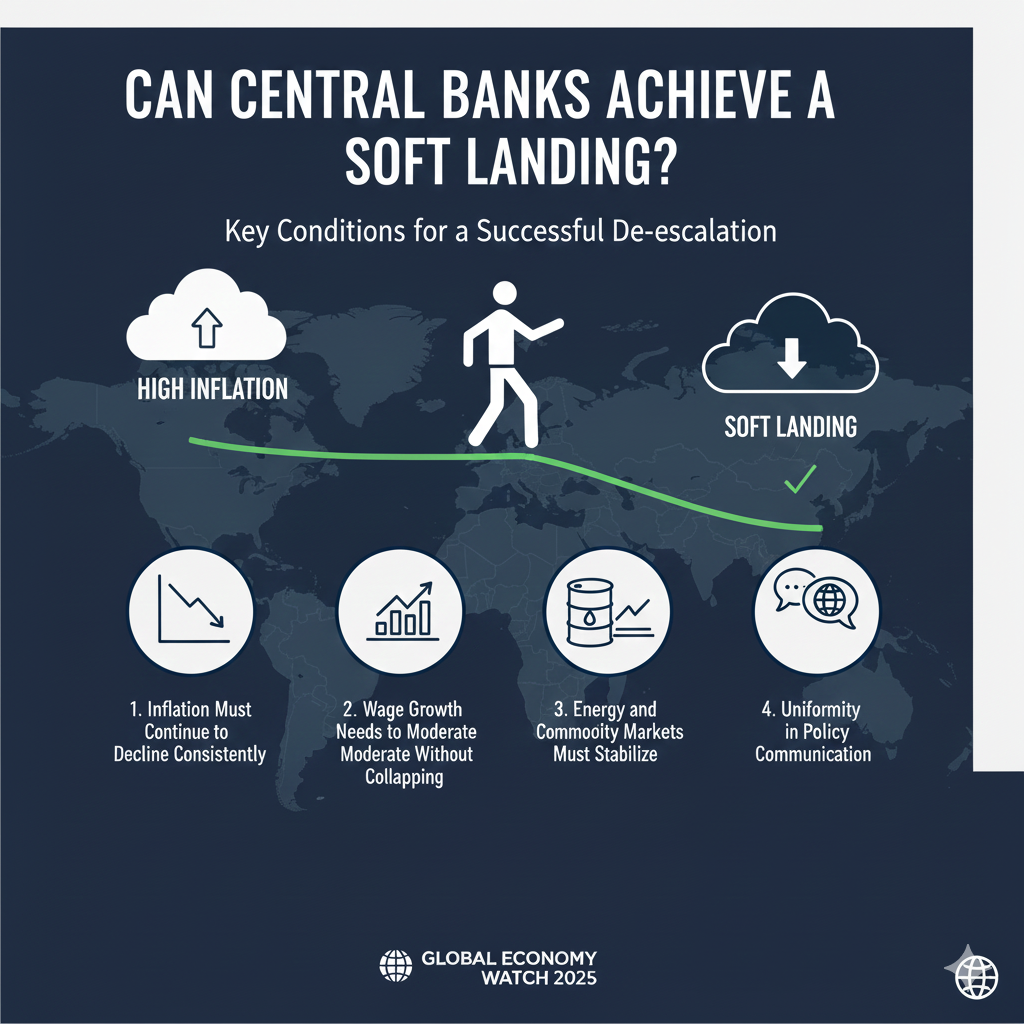

Can Central Banks Achieve a Soft Landing?

Many economists believe a soft landing is still possible-but only if several conditions align:

1. Inflation must continue to decline consistently.

Central banks will have room to gradually cut rates if price pressures fall toward target levels.

2. Wage growth needs to moderate without collapsing.

A healthy slowdown of wage gains is what brings down inflation without harming workers.

3. Energy and commodity markets must stabilize.

One of the major risks is still volatility in oil and gas prices.

4. Uniformity in the communication of policies.

Clear guidance minimizes market uncertainty and prevents financial instability. If any of those variables worsen, then the possibility of recession increases manyfold.

The Most Likely Scenario For 2025

Current projections indicate that many economies may narrowly avoid a deep recession but still experience sluggish growth or a mild downturn. An ideal soft landing is feasible but fragile, contingent on how inflation evolves during the coming months. This is a tightrope that central banks must walk carefully, managing inflation expectations without choking economic activity. Decisions taken at the start of and into mid-2025 will have a decisive role to play in shaping world growth for years to come.

Conclusion

Among the most complicated economic challenges of the decade has been the effort to tame inflation without triggering a recession. While central banks have made progress, the job is far from over. High interest rates, weakening consumer demand, and global uncertainties continue to shape a fragile outlook. Whether the world ends up with a soft landing—or slips into recession—will depend on how carefully policymakers balance inflation control with economic stability.