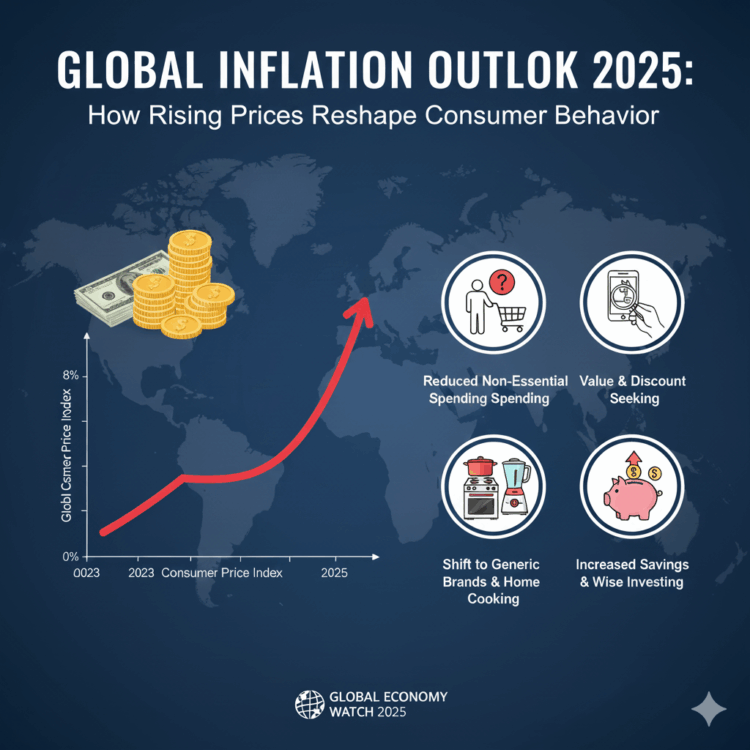

Inflation in 2025 is one of the most intransigent economic problems facing the world. Global inflation rates have only gradually worked their way off their post-pandemic peaks, leaving high commodity and service prices in the majority of the world’s economies. Shifts in supply chains, geopolitical conflict, unstable energy prices, and burgeoning labor pressure-all contribute to a new inflation landscape, one resistant to change and hence more difficult to manage.

These price pressures have greatly changed consumer behavior and are remodeling the ways in which households are spending, saving, and making financial decisions. Understanding those shifts is key for businesses, policymakers, and others trying to navigate today’s economic landscape.

Global Inflation Trends in 2025

By 2025, inflation could be very different depending on the region in which one resides.

- US & Europe: Inflation cools but stays above the targets set by the central banks on account of increases in service sectors like healthcare, transportation, and housing.

- Asia: Inflation is more stable, though still influenced by fluctuating energy prices and export-related pressures.

- Emerging Markets: These show graver inflation; the reason being that depreciation of currency and higher import prices have risen.

Although below the peaks reached in 2022–2023, inflation rates are still high enough to weigh on consumer sentiment and everyday spending.

What Underpins the Headline Inflation in 2025

a. Supply Chain Restructuring

This has led many companies to substitute nearshoring or friend-shoring for offshoring in the post-pandemic period. While all these strategies together improve supply chain resilience, they also increase production and logistical costs and, hence, consumer prices.

b. Energy Price Volatility

Global oil and gas markets continue to be volatile amid geopolitical conflict and the production strategies of key energy exporters. Volatile energy prices are hitting the transportation, manufacturing, and retail industries.

c. Increasing labor costs

Labor shortages have put upward pressure on wages across many industries. This has raised household incomes, to be sure, but it also raises operating costs for companies that often get passed on to consumers.

d. Climate-related disruptions

Extreme weather conditions disrupt agricultural production in all regions, raise the prices of food, and hence affect the food security of poorer regions.

How Rising Prices Are Changing Consumer Behavior

Inflation is about the very psychology of consumption, not just what happens to the prices of goods and services. New habits will be adopted by consumers in 2025 amidst financial pressure.

a. Shift of Focus towards Essential Spending

Households would have to prioritize needs such as food, healthcare, rent, and utilities. Spending on non-essential categories of luxury goods, travel, and entertainment falls as consumers turn cautious.

b. Shopping Becomes More Value-Driven

Rising prices accelerate the movement toward more price-conscious behavior. Hence, consumers are increasingly:

- Opt for private-label or budget brands.

- Compare Prices Across Websites & Apps

- Look for discounts, vouchers, and other promotions.

- Make large purchases when prices have fallen.

This may weaken brand loyalty, hence increasing the level of competition among retailers.

c. Preference for buying in bulk and saving for a long period.

Households economize by buying in bulk or subscribing to products offering price stability. Products providing durability, value over time, and energy efficiency become more attractive.

d. Rapid Adoption of Digital Financial Tools

Digital platforms help consumers cope more effectively with inflation. In this respect, people make use of:

- Budgeting and expense-tracking apps

- Price Comparison Tools

- Cashback and rewards programs

- Buy Now Pay Later services

These tools are transparent and offer control; this makes the management of a household easier due to increasing expenses.

e. Cooking at Home Instead of Eating Out

With restaurants becoming more expensive faster than groceries, many families cook more meals at home, thereby slowing the rate of restaurant spending across a number of countries.

Impact on Businesses and Market Strategies

Changes in inflation-forced consumer behavioral changes have forced businesses to shift.

a. New Pricing Strategies

Companies use the following to maintain profitability without driving away customers:

– Dynamic pricing

– Product bundling

– Shrinkflation-smaller product sizes at stable prices

b. Focus on Transparency and Value

Consumers have become increasingly mistrusting of non-transparent pricing. At a time of inflation, brands have the opportunity to shore up more consumer trust than ever by revealing themselves as transparent, durable, and values-driven.

c. Supply Chain Diversification

Companies continue to diversify their supplies, invest in regional production, and automate operations to reduce future supply chain volatility and cost risk.

d. Demand for sustainable products

The demand for such eco-friendly products is particularly high for those products offering cost savings, such as energy-efficient appliances or items that can be reused.

Outlook for Inflation for the Rest of 2025

Economists predict global inflation will ease slowly through 2025, but it could take well into the future before it settles back to pre-pandemic levels. With structural changes in supply chains, labour markets, and energy systems, a new long-run average can be expected with prices sustainably higher than in the years preceding 2020. Improving economic prospects will not dispel consumer caution. Value-conscious shopping, digital budgeting, and reduced discretionary spending forged in inflationary conditions are here to stay.

Conclusion

The world’s inflation in 2025 is more than a short-term economic problem; it’s changing patterns of consumption in ways that will last. Households have turned strategic, value-oriented, and digitally enabled, while businesses would need to be transparently priced, supply chain resilient, and customer-centric in their strategies. The world will continue adjusting to new patterns of consumption that remake the global economy as inflation slowly moderates.