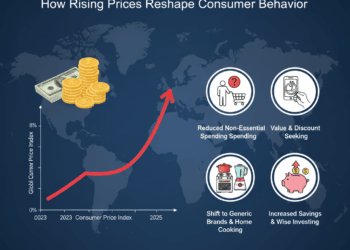

It is only in the last couple of years that this inflation has turned into one of the major economic challenges many families in the world face today. This forces people to really rethink how, where, and when they spend their money because of the increased price of goods and services. Though inflation is not new, its recent impact on today’s globalized and digitized world is probably something that has never been seen. Every spending decision today-from groceries and fuel to housing and entertainment-is presently made with a deeper level of deliberation.

The New Normal of Spending

Inflation has repositioned spending psychology in many customers’ minds. Whereas convenience or brand loyalty might have been the emphases in times past, the price sensitivity element now overrides those considerations. Shoppers compare prices more frequently than before, seek out discounts, and substitute premium brands with affordable alternatives. Even in developed markets, the middle class is being very cautious about discretionary purchases, such as luxury items or dining out frequently.

Digital platforms have changed the way in which one experiences inflation: price tracking tools and online marketplaces make today’s consumer extremely informed. Such transparency helps people adapt in response to market fluctuations while heating up the competition among firms. Today, a company needs to balance profitability with affordability in order to retain customer trust and loyalty.

Shift to Value and Need

For example, there has been a shift from impulsive to intentional spending. While consumers have cut discretionary spending, food, health, housing, and education are now essential needs that dominate. Many people are reviewing their subscriptions and membership: most households canceled subscriptions never used as a means of reducing expenses. This is an indication that people are not just cutting costs; they are redefining what value means to them.

Coupled with this value system are the issues of sustainability and durability. Instead of buying multiple low-cost items, people would rather buy something that may last longer or reduce harm to the environment. Companies that build quality into what they produce, source materials with ethics in mind, and produce for long-term reliability will be favored in this type of thinking.

Digital Transformation in Consumer Behavior

Paradoxically, the digital economy in these inflationary times is at once the solution and a challenge. E-commerce platforms, digital banking, and even the ways of mobile payment make price comparisons and finance management incredibly effective. Many people have turned to financial applications that can track spending and provide real-time budgeting, giving them great control over their spending.

On the other side of that convenience is the possibility of overspending through online promotions, flash sales, and one-click purchasing. That is why financial literacy nowadays is important; it is a must to learn how to handle digital spending habits responsibly in order to protect one’s financial stability during high inflationary periods.

The Business Perspective

For businesses, it is all about adapting to these changed habits. Companies that can offer flexible pricing, loyalty rewards, and personalized discounts retain their customers for much longer. Brands communicating transparency regarding pricing and production garner more trust. Businesses that cannot adapt to these changes risk losing an advantage in a price-sensitive market.

At the same time, one of the big survival strategies is turning out to be innovation. Automation, efficient supply chains, and data-driven insights enable companies to cut costs without sacrificing quality and thus keep products affordable. Never has the relation between technology and consumer satisfaction been so strong.

Concluding Thoughts

Inflation has structurally changed how people spend money-from discretionary to necessary, from impulse to intended, and from quantity to quality. With consumers being better informed and cautious, businesses, too, need to change to meet these new expectations of transparency, value, and trust.

But while inflation is a very tangible financial challenge, it does bring about wiser spending, innovation, and more conscious consumption. And in many ways, it has meant that both consumers and companies have been forced to think about what really matters: sustainability, value, and adaptability in an ever-changing economy.