A sea of change, led by a new kind of investor-the millennials-is sweeping across the investment world. Millennial investors came of age from the early 1980s to the mid-1990s, growing up in an increasingly digital world characterized by globalization and economic turbulence. In contrast to earlier generations, they have a very different perspective on money, success, and investing-one focused on values, ease, and purpose. This generational shift in investing stands poised to redefine how people invest and what investing will mean in the 21st century.

A Generation Shaped by Experience

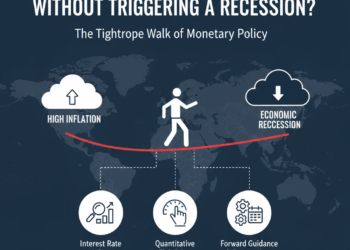

The millennials came of age during some pretty significant economic challenges in modern history, including the financial crisis of 2008 and the COVID-19 pandemic. Those experiences taught them important lessons about financial instability, risk, and the limits of traditional investment systems. As a result, millennials tend to be cautious yet innovative investors.

Apart from the generations that came before them, millennials do not look toward their companies for a lifelong career and a retirement pension; rather, they would prefer financial independence. More than a few have embraced digital platforms, side hustles, and entrepreneurship as part of their wider investment strategy, while alternative investments-from cryptocurrencies and peer-to-peer lending to sustainable startups-are far more palatable to this group.

The Digital Investor Revolution

Technology is the defining feature of the millennial investment mindset. This generation embraces everything from online trading platforms and mobile applications to robo-advisors as a way to make investing more accessible and transparent. Digital tools make it possible for them to invest small sums of money, track market performance in real time, and diversify their portfolios with very little effort.

Millennials prize their autonomy and information most. They would rather do their research, relying heavily on social media discussions, financial podcasts, and influencer insights to guide decisions. All of this has democratized financial knowledge that once served as a significant barrier to entry; today, literally anyone with a smartphone can be an investor. This leads to a better-connected, better-informed, and independent investment community.

Investing with a Purpose

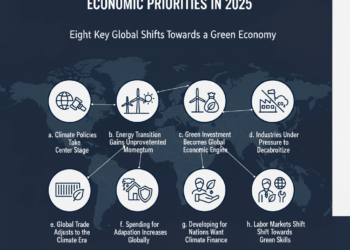

Perhaps the most defining characteristic of millennial investors is a focus on purpose-driven investment. To millennials, it is not good enough that it should yield only financial returns; it has to create positive social and environmental impact. These have fueled the rise of Environmental, Social, and Governance-ESG investing, a framework that looks at and favors companies committed to sustainability, ethics, and social responsibility.

They are also at the leading edge when it comes to support for green technologies, renewable energy, and diverse businesses. Millennials believe that investing needs to align with their personal values and contribute to making the world a better place. Thus, they were sending big corporations a message on the need for more transparent and responsible policies to deal with this new wave of investors.

Challenges and Opportunities Ahead

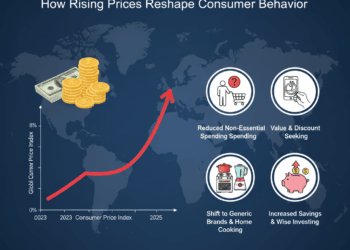

While millennials are indeed changing the investment landscape, they also face several new challenges. With rising living costs, student debt, and housing affordability issues, building wealth through traditional means has become more difficult for many people. But such constraint fosters innovation. The rise of fractional investing-whereby people can buy small shares of high-value assets-has made it possible for millennials to participate in markets that were previously beyond their reach.

Another highlight has been for financial literacy. Online educational platforms and communities will be crucial enablers in empowering millennials to make better investing decisions for a generation that increasingly wants to learn about investing.

Final Thought: New Era of Investing

However, millennials are not only changing the way people invest; they are also redefining why people invest. The combination of digital fluency, social awareness, and entrepreneurial spirit has created a more inclusive, transparent, and purpose-driven investment world. As technology advances, millennial investors will remain one of the driving forces of global financial innovation. By shaping the investing landscape of tomorrow, they prove that profit and purpose can go together.